Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

Planning to Work Past 65?

Here’s What You Need to Know More Americans are working past the traditional retirement age. According to the U.S. Bureau of Labor Statistics, nearly a third of people aged 65 to 74 are expected to remain in the workforce by 2026. Whether for financial reasons or personal fulfillment, working beyond 65 is increasingly common—but it requires careful planning when it comes to Medicare. At McDonald Group Insurance Services, we specialize in helping individuals understand how to transition to Medicare with confidence, especially after delaying enrollment due to employer health coverage.

Delaying Medicare: Are You Eligible?

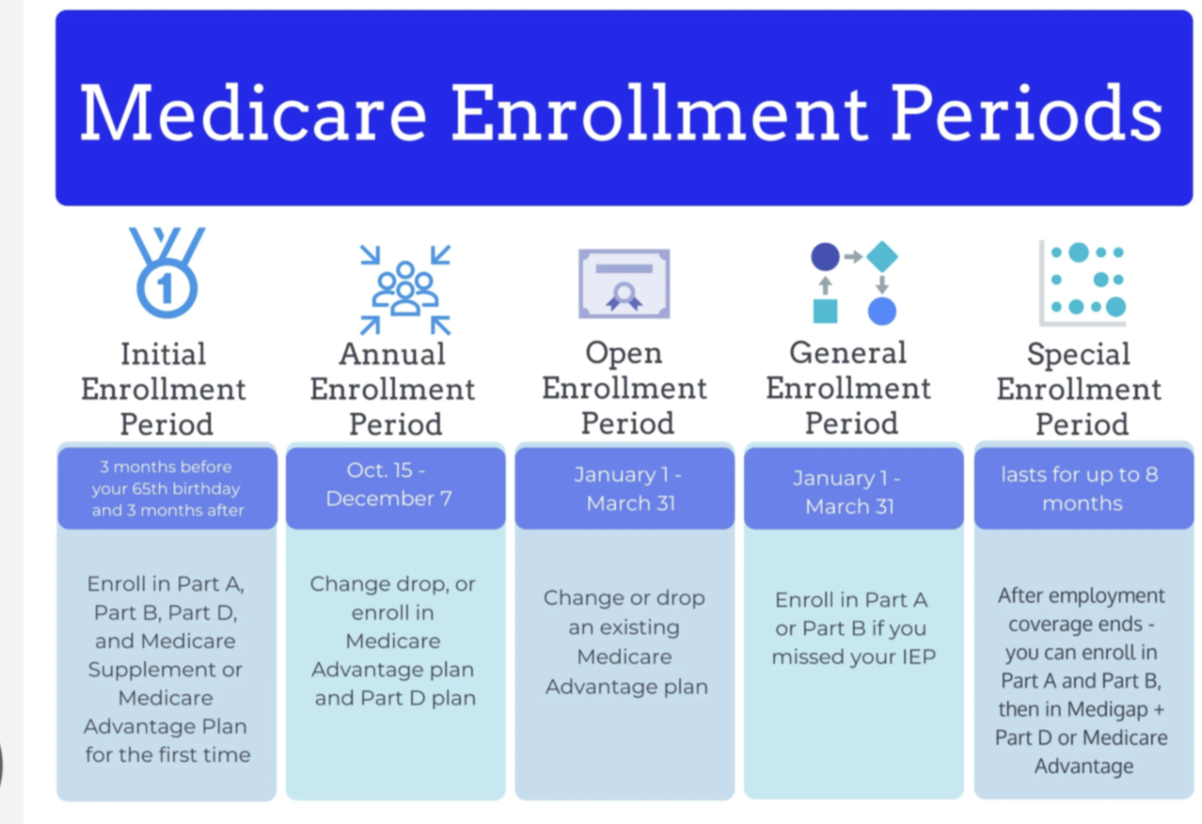

If you or your spouse have active group health coverage through an employer with 20 or more employees, you can delay enrolling in Medicare without incurring late penalties. This type of plan is considered creditable coverage, which means it meets Medicare’s minimum standards. Once you leave that employer coverage—whether by retiring or losing the job—you have an 8-month Special Enrollment Period (SEP) to enroll in Medicare Part B without penalty.

Working for a Smaller Employer?

If your employer has fewer than 20 employees, Medicare becomes your primary insurance, and you should not delay enrollment in Parts A and B. Doing so can lead to late enrollment penalties and coverage gaps. In this case, even if you have group insurance, you’ll need to enroll in Medicare when you become eligible.

Medicare Enrollment Breakdown

Medicare Part A

Most people qualify for premium-free Part A. It’s often recommended to enroll even while working, as it can act as secondary insurance for hospital stays. However, if you contribute to a Health Savings Account (HSA), you should not enroll in Part A. Having Medicare while contributing to an HSA can trigger IRS penalties. If you delay Part A and apply for it after your full retirement age, Medicare may backdate your coverage by six months. Plan ahead by stopping HSA contributions at least six months before applying.

Medicare Part B

**** If you have creditable employer coverage, you can delay Part B until retirement. Once you leave your job or your coverage ends, your 8-month SEP begins. To apply, you must complete two forms: CMS-40B: Application for Part B CMS-L564: Employer verification of coverage These can be submitted online, by mail, or in person at a Social Security office. If your employer can’t fill out the CMS-L564, you may submit alternate proof such as: Insurance cards with coverage dates Pay stubs showing premium deductions Tax documents showing health insurance payments

IRMAA and Part B Premium Adjustments

If you had a higher income before retirement, your Medicare premiums might include an Income-Related Monthly Adjustment Amount (IRMAA). You can appeal this if you've experienced a life-changing event, such as retirement, marriage, divorce, or the death of a spouse.

Medicare Part D (Prescription Drug Coverage)

If you delay Medicare and remain on employer coverage, you may also delay Part D—but only if your employer coverage includes creditable drug benefits. When your employer coverage ends, you have a 2-month window to enroll in a Part D plan without penalty. You can choose a plan through the Medicare Plan Finder or work with McDonald Insurance Group Services to find one that fits your prescription needs.

Medicare Supplement (Medigap) Plans

Once your Part B coverage begins, you enter a 6-month Medigap Open Enrollment Period. During this time, you can sign up for any Medigap plan without being denied based on health conditions. Alternatively, if you delayed enrollment due to employer coverage and later lost that coverage, you may qualify for a 63-day Guaranteed Issue (GI) window. This allows you to enroll in certain Medigap plans without underwriting. Available plans under GI rights differ based on when you became Medicare-eligible: Before 2020: Plans A, B, C, F, K, and L 2020 or later: Plans A, B, D, G, K, and L

Medicare Advantage Plans (Part C)

You must have both Part A and Part B to join a Medicare Advantage plan. Once your employer coverage ends, you have a 2-month SEP to enroll. Most Medicare Advantage plans include Part D drug coverage.****

HSA Reminders When Transitioning to Medicare

You cannot contribute to an HSA while enrolled in any part of Medicare. Since Part A coverage may be retroactive by six months if you apply late, it’s best to stop HSA contributions six months before enrolling in Medicare to avoid tax issues.

Final Thoughts: Prepare Early

Navigating Medicare after 65, especially while still employed, requires timely action. Enrollment rules are not one-size-fits-all and depend heavily on your employer’s size and health benefits. Start planning at least six months before retirement to avoid stress and ensure continuous coverage. At McDonald Group Insurance Services, we help individuals every day with their Medicare transition. Let our experienced team guide you through enrollment and help you choose the right plan based on your unique circumstances. Need help understanding your Medicare options? Contact McDonald Group Insurance Services today.

Feb 11, 2026

026 Medicare Enrollment Dates: AEP, IEP, & GEP Guide Don't miss a deadline! Learn the key 2026 Medicare enrollment periods, from your 65th birthday to annual open enrollment, and avoid lifetime penalties. Medicare enrollment periods 2026, initial enrollment period, an

Feb 02, 2026

2026 Medicare Cost Guide: Part A, B, & D Premiums Explained,Stay prepared for 2026! Discover the new Medicare Part B premium of $202.90, the Part D $2,100 out-of-pocket cap, and Part A hospital costs.

Jul 15, 2025

Working past 65? Learn how employer size, HSAs, and Medicare enrollment rules affect your health coverage. Get expert guidance from McDonald Group Insurance Services.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.