Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

If you're like many people, thoughts of retirement start to take shape in your 40s—dreams of travel, hobbies, and more free time. What rarely crosses the mind, though, is the cost of healthcare in retirement. According to the Urban Institute, someone retiring today can expect to spend over $300,000 on medical expenses during retirement—and potentially over $500,000 if they live into their 90s.

Understanding Medicare is essential to navigating these costs. At McDonald Group Insurance Services, we frequently hear the same questions from clients who are preparing for or newly enrolled in Medicare. Here are seven of the most common—and most misunderstood—questions:

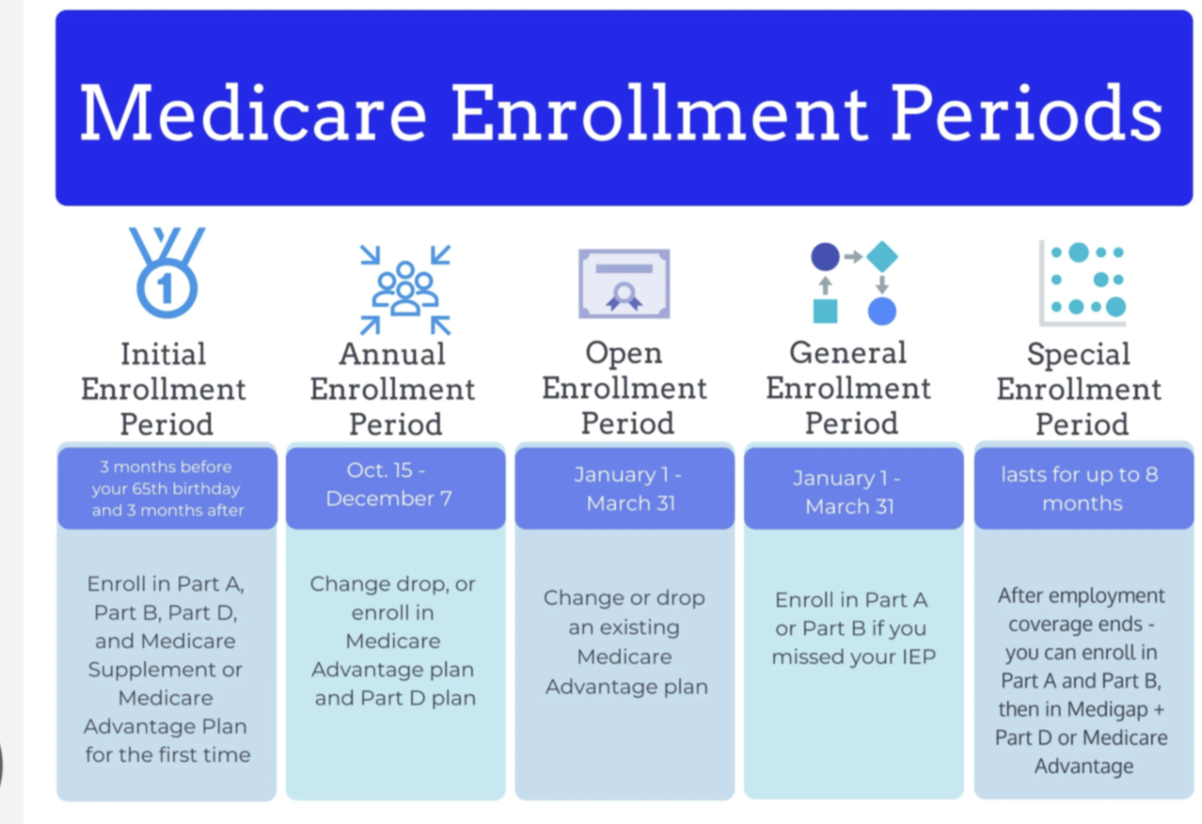

1. Do I Have to Choose Between Original Medicare and Medicare Advantage? When you first become eligible for Medicare, you must decide between Original Medicare (Part A and B) or a Medicare Advantage plan (Part C). A surprising number of people believe this decision is permanent, but that's not the case. You’re not locked into your initial choice. If you opt for Medicare Advantage and change your mind within the first 12 months, you can switch to Original Medicare and retain your guaranteed issue rights for Medigap. Additionally, the Medicare Annual Enrollment Period (October 15 to December 7) and the Medicare Advantage Open Enrollment Period (January 1 to March 31) allow for plan changes each year. Moving or losing plan availability also grants you the chance to switch coverage. So no matter your situation, you generally have flexibility to adjust your Medicare plan as your needs evolve.

2. Does Medicare Cover Long-Term Care? A widespread myth is that Medicare pays for long-term care. In truth, it only covers short-term skilled nursing care following a hospitalization. Routine custodial care in a nursing home or assisted living facility is not covered. With 70% of retirees needing some form of long-term care—and men averaging 2.2 years and women 3.7 years—this can be a major financial strain. A semi-private nursing home room can cost around $7,000 per month. To prepare, consider either saving specifically for these costs or investing in long-term care insurance. Premiums typically range from $1,500 to $2,500 annually depending on age and policy type. For many, this insurance can offer significant financial protection.

3. Can I Enroll in Medicare As Soon As I Retire? Medicare eligibility is based on age, not retirement status. Unless you qualify due to disability, you’ll need to wait until you’re 65 to enroll—even if you retire at 62. It’s crucial to understand your enrollment windows, because missing them can result in late penalties. If you delay enrollment without having qualifying alternative coverage, those penalties can be permanent, especially for Medicare Part B and Part D.

4. Does Medigap Cover All Out-of-Pocket Costs? Medigap plans help with certain out-of-pocket expenses under Original Medicare—but they don’t eliminate all costs. These plans are standardized by the government, so a Plan G offers the same benefits regardless of the insurance provider. However, since 2020, new Medigap policies no longer cover the Medicare Part B deductible. Also, Medigap doesn’t cover premiums, prescription drugs (Part D), or services like dental and vision care. And remember, Medigap only works with Original Medicare—not Medicare Advantage. If you opt for a Medicare Advantage plan, you can't buy a Medigap policy to supplement it.

5. Can I Purchase Medigap Anytime? You can apply for a Medigap plan anytime, but outside your guaranteed issue period, insurance companies can use medical underwriting to deny you or charge more based on health history. The best time to buy a Medigap policy is during your Medigap Open Enrollment Period—a six-month window starting when your Part B coverage begins. During this time, you can choose any plan available in your state without facing health questions. If you initially choose a Medicare Advantage plan but want to switch back to Original Medicare during the first year, you’ll get a special window to enroll in a Medigap plan with guaranteed acceptance. Outside of these situations, qualifying for a new plan can be difficult if your health changes, so it’s wise to think long-term when choosing coverage.

6. Does Medicare Have an Annual Out-of-Pocket Maximum? Original Medicare (Parts A and B) does not have an out-of-pocket maximum, which can leave you exposed to significant costs. Medigap plans are the only way to protect yourself from unlimited medical expenses under Original Medicare. Medicare Advantage plans, on the other hand, do have an annual out-of-pocket limit. For 2025, this limit is capped at $9,350 by the federal government, though many plans set much lower thresholds—especially for in-network services. However, this cap doesn’t apply to prescription drug costs, which follow separate Part D rules.

7. Does Medicare Include Dental and Vision Care? Original Medicare does not cover routine dental or vision services. It will cover specific medical issues—such as cataract surgery or treatment for an eye injury—but not routine exams, glasses, or dental cleanings. Some Medicare Advantage plans include limited dental, vision, and even hearing benefits. Coverage amounts and services vary widely, so it’s important to compare plans carefully based on what’s offered in your area. At McDonald Group Insurance Services, we’re committed to helping you make informed decisions about your Medicare options so you can avoid unexpected costs and enjoy peace of mind in retirement. Understanding your coverage—and where the gaps are—is the first step to long-term healthcare planning.

Feb 11, 2026

026 Medicare Enrollment Dates: AEP, IEP, & GEP Guide Don't miss a deadline! Learn the key 2026 Medicare enrollment periods, from your 65th birthday to annual open enrollment, and avoid lifetime penalties. Medicare enrollment periods 2026, initial enrollment period, an

Feb 02, 2026

2026 Medicare Cost Guide: Part A, B, & D Premiums Explained,Stay prepared for 2026! Discover the new Medicare Part B premium of $202.90, the Part D $2,100 out-of-pocket cap, and Part A hospital costs.

Jul 15, 2025

Working past 65? Learn how employer size, HSAs, and Medicare enrollment rules affect your health coverage. Get expert guidance from McDonald Group Insurance Services.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.