Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

A Beginner’s Guide to Getting Started with Medicare

Turning 65 is a significant milestone, and for many, it means the start of Medicare coverage. If you're new to Medicare, the process can feel overwhelming, but understanding the basics can help make the transition easier. In this blog, we'll walk you through the essentials of Medicare, what you need to know, and how to make the most of your benefits.

Medicare is a federal health insurance program designed primarily for individuals age 65 and older. However, some younger people with disabilities or certain medical conditions (like end-stage renal disease) are also eligible. Medicare provides coverage for a wide range of health services, but it doesn't cover everything. That’s why it’s essential to understand how Medicare works and what options are available to fill the gaps.

Medicare is divided into several parts, each covering different aspects of healthcare:

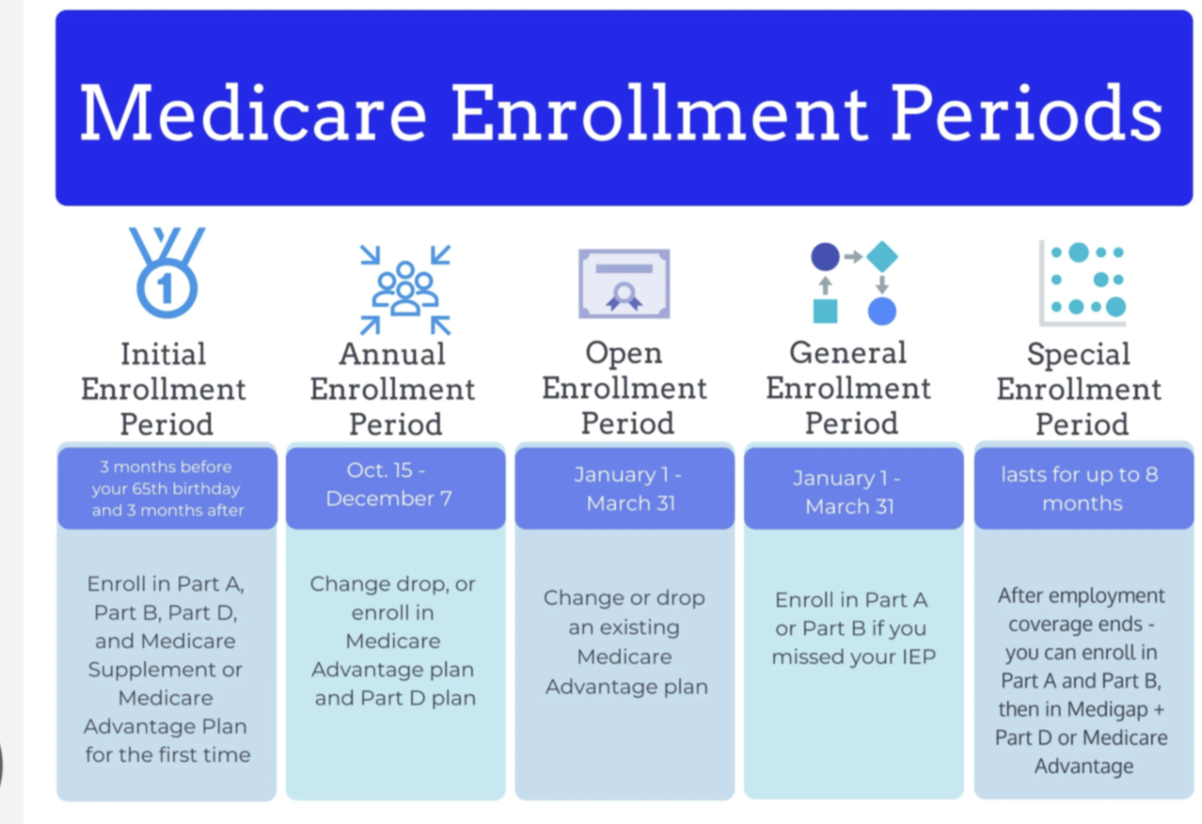

You can begin Medicare coverage when you turn 65, but you must take action to enroll. Your Initial Enrollment Period (IEP) begins three months before your 65th birthday, includes the month of your birthday, and ends three months after. If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Part A and Part B. If you’re not receiving Social Security benefits, you’ll need to sign up for Medicare through the Social Security Administration (SSA).

If you miss your IEP and are still working or have health coverage through an employer, you may be eligible for a Special Enrollment Period to sign up for Medicare without facing a late enrollment penalty. Be sure to sign up as soon as your work-based insurance ends to avoid a gap in coverage.

Original Medicare (Parts A and B) doesn’t cover all healthcare expenses. That’s where Medigap, or Medicare Supplement Insurance, comes in. Medigap policies, sold by private insurance companies, help cover out-of-pocket costs like copayments, coinsurance, and deductibles.

There are 10 standardized Medigap plans (labeled A through N), and each plan offers a different level of coverage. If you prefer more comprehensive coverage, you may want to consider enrolling in a Medigap plan.

You have two main options when it comes to your Medicare coverage:

Choosing between these options depends on your healthcare needs, budget, and preferences. Medicare Advantage plans may offer more comprehensive coverage, but you may have to work within a network of doctors and providers.

One of the most important things to consider when you’re new to Medicare is the costs:

Medicare doesn’t cover most prescription drugs through Original Medicare (Part A and Part B), which is why Part D is essential. Part D helps cover prescription medications, and you can get this coverage through:

Make sure to evaluate your current medications and compare plans to find the best Part D or Medicare Advantage plan that meets your needs.

If you’re still working and have employer-sponsored health coverage, you may be able to delay enrolling in Medicare without penalty. However, once you stop working or lose your employer coverage, you’ll need to sign up for Medicare. Make sure to check if your employer’s insurance is considered creditable prescription drug coverage, which allows you to delay enrolling in Part D without facing a penalty.

Navigating Medicare can be complicated, but there are resources to help you:

Medicare is constantly evolving, and it’s essential to stay informed about changes to coverage, costs, and enrollment periods. Each year, Medicare holds an Annual Enrollment Period (AEP) from October 15 to December 7, during which you can switch, add, or change your coverage for the following year. Pay attention to notices of changes in your plan and review your options to ensure your coverage still meets your needs.

Starting Medicare is a big transition, but with the right knowledge and planning, you can take full advantage of the coverage available. Whether you choose Original Medicare, Medicare Advantage, or a Medigap plan, understanding your options and costs will help you make informed decisions and ensure you get the health coverage you need.

If you’re unsure where to start, don't hesitate to reach out to McDonald Group Insurance services we will be more than happy to guide you through the process.

Feb 11, 2026

026 Medicare Enrollment Dates: AEP, IEP, & GEP Guide Don't miss a deadline! Learn the key 2026 Medicare enrollment periods, from your 65th birthday to annual open enrollment, and avoid lifetime penalties. Medicare enrollment periods 2026, initial enrollment period, an

Feb 02, 2026

2026 Medicare Cost Guide: Part A, B, & D Premiums Explained,Stay prepared for 2026! Discover the new Medicare Part B premium of $202.90, the Part D $2,100 out-of-pocket cap, and Part A hospital costs.

Jul 15, 2025

Working past 65? Learn how employer size, HSAs, and Medicare enrollment rules affect your health coverage. Get expert guidance from McDonald Group Insurance Services.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.