Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

Understanding Medicare Advantage Special Needs Plans (SNPs) By McDonald Group Insurance Services. When it comes to Medicare, there are several plan options available, and one of the most tailored choices is the Medicare Advantage Special Needs Plan (SNP). These plans are designed for individuals with specific health conditions or unique situations, providing benefits that go beyond what Original Medicare offers. Offered by private insurance companies, SNPs are only available to people who meet certain eligibility requirements—and who are already enrolled in Medicare Parts A and B.

What Are Medicare Advantage Special Needs Plans? Special Needs Plans (SNPs) fall under the umbrella of Medicare Advantage (Part C). Like all Medicare Advantage plans, SNPs include coverage for all services offered under Parts A and B, such as: Inpatient hospital care Outpatient services Skilled nursing facility care Home health care Durable medical equipment (DME) Preventive screenings and services Surgeries and diagnostic testing However, SNPs go a step further by offering additional benefits tailored to the needs of the populations they serve. These may include: Vision exams, glasses, or contact lenses Dental care Hearing exams and hearing aids Gym memberships or fitness programs Nutrition and wellness support Transportation to medical appointments Adult daycare services Prescription drug coverage (required for all SNPs) Specialized care coordination for chronic conditions The prescription drug plans included in SNPs are customized for the specific health needs of the individual, ensuring better medication management and access. Coordinated Care for Chronic Conditions One of the standout features of SNPs is condition-specific care coordination. If you have a qualifying chronic illness, your SNP will include access to services and programs designed to support your overall health. These services may include help with medication management, dietary guidance, and personalized activity plans—all aimed at improving your condition and quality of life. SNPs also often provide better access to a network of specialists and facilities experienced in treating your specific health issue.

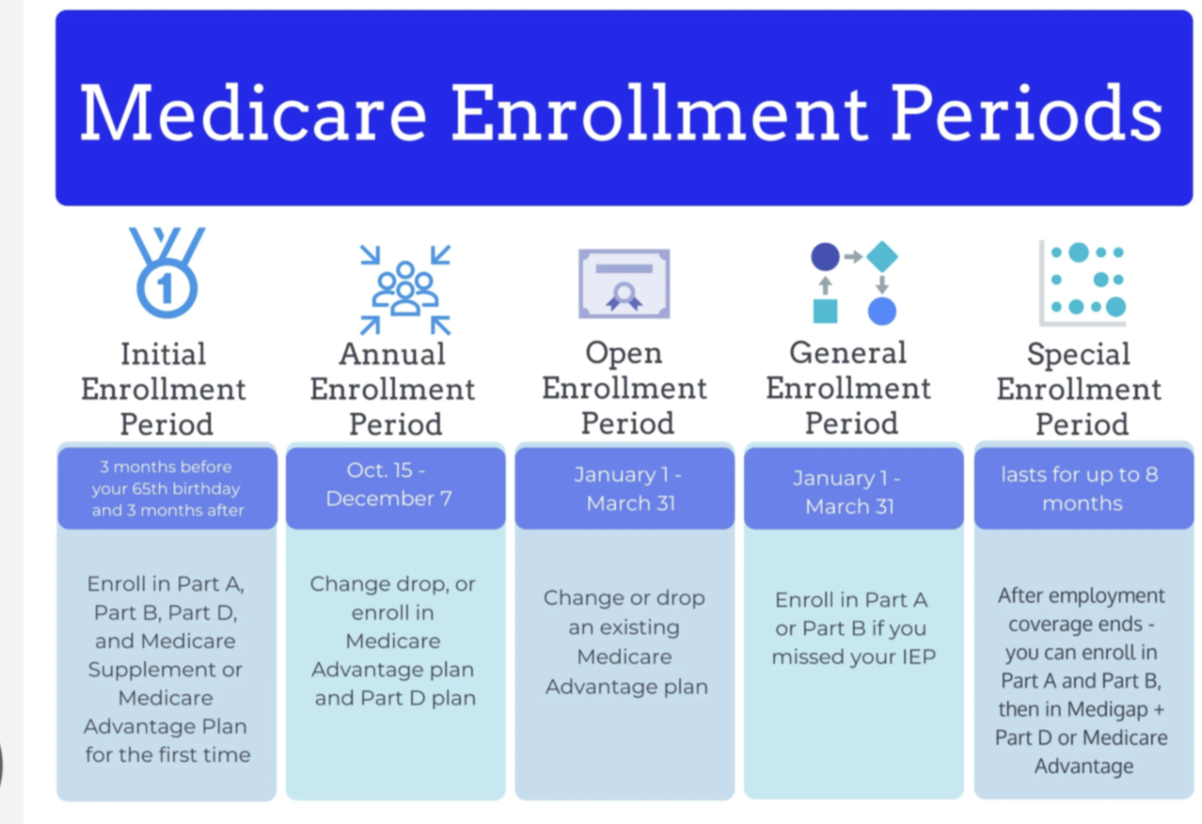

To enroll in a Medicare Advantage SNP, you must first be enrolled in Medicare Part A and Part B. Enrollment into a SNP must occur during one of the established Medicare enrollment periods: Initial Enrollment Period (IEP) You’re first eligible to enroll in Medicare three months before your 65th birthday, and you have a total of seven months to enroll (three months before, your birthday month, and three months after). If you’re receiving Social Security Disability Insurance (SSDI), you can enroll in Medicare after 24 months of disability benefits. Your enrollment window begins three months before your 25th month of benefits and lasts for three months after. Special Enrollment Period (SEP) You may qualify for a SEP under specific conditions.

Common examples include: You delayed Medicare enrollment because you had other creditable insurance You move out of your current plan’s service area Your existing plan ends through no fault of your own You become eligible for Extra Help If you think you may qualify for a SEP, McDonald Insurance Group Services can help assess your eligibility and walk you through the enrollment process. Annual Election Period (AEP) Each year from October 15 through December 7, you can enroll in, change, or drop a Medicare Advantage plan. Changes made during this time take effect on January 1 of the following year. Medicare Advantage Open Enrollment Period (OEP) From January 1 to March 31, you have another chance to make changes. During this time, you can: Switch from one Medicare Advantage plan to another Drop your Medicare Advantage plan and return to Original Medicare Enroll in or switch your Medicare Part D (drug coverage) plan Types of Medicare Advantage Special Needs Plans There are three main types of SNPs, each designed for a different group of people: 1. Chronic Condition SNP (C-SNP) These plans serve individuals diagnosed with severe or disabling chronic conditions such as: Cancer Diabetes Cardiovascular disease HIV/AIDS Dementia Autoimmune disorders 2. Dual-Eligible SNP (D-SNP) This option is for people who qualify for both Medicare and Medicaid. These plans often include extra assistance with premiums, copays, and other out-of-pocket costs. 3. Institutional SNP (I-SNP) Designed for individuals living in institutional settings, such as nursing homes, or those requiring nursing-level care at home. How McDonald Insurance Group Services Can Help Choosing the right Medicare Advantage Special Needs Plan can be overwhelming, but you don’t have to figure it out alone.

At McDonald Group Insurance Services, our licensed Medicare advisors are here to help you: Understand your eligibility Compare SNP options Navigate the enrollment process Choose a plan that best suits your medical needs and financial situation We provide personalized consultations to ensure you're equipped with the knowledge and confidence to select the right plan. Ready to Explore Your SNP Options? Contact McDonald Group Insurance Services today for a free consultation and expert guidance. Our goal is to make Medicare simple and stress-free so you can focus on what matters most—your health. 📞 Call us at 229-457-6943

Feb 11, 2026

026 Medicare Enrollment Dates: AEP, IEP, & GEP Guide Don't miss a deadline! Learn the key 2026 Medicare enrollment periods, from your 65th birthday to annual open enrollment, and avoid lifetime penalties. Medicare enrollment periods 2026, initial enrollment period, an

Feb 02, 2026

2026 Medicare Cost Guide: Part A, B, & D Premiums Explained,Stay prepared for 2026! Discover the new Medicare Part B premium of $202.90, the Part D $2,100 out-of-pocket cap, and Part A hospital costs.

Jul 15, 2025

Working past 65? Learn how employer size, HSAs, and Medicare enrollment rules affect your health coverage. Get expert guidance from McDonald Group Insurance Services.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.