Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

Medicare Part D Standard Benefits for 2024 have been updated by the Centers for Medicare and Medicaid Services. All drug plans have basic minimums and thresholds that are set by Medicare. This means that all drug plans must follow these standard outlines set by Medicare or improve upon them. This blog will show you how each stage of the drug plan works for 2024.

Medicare Part D prescription drug plans operate within a four-stage framework. Understanding each stage empowers you to make informed decisions about your coverage and optimize your medication costs.

By understanding the structure of your Medicare Part D plan and taking advantage of available resources, you can make informed decisions to optimize your prescription drug coverage and manage medication costs effectively.

Feb 11, 2026

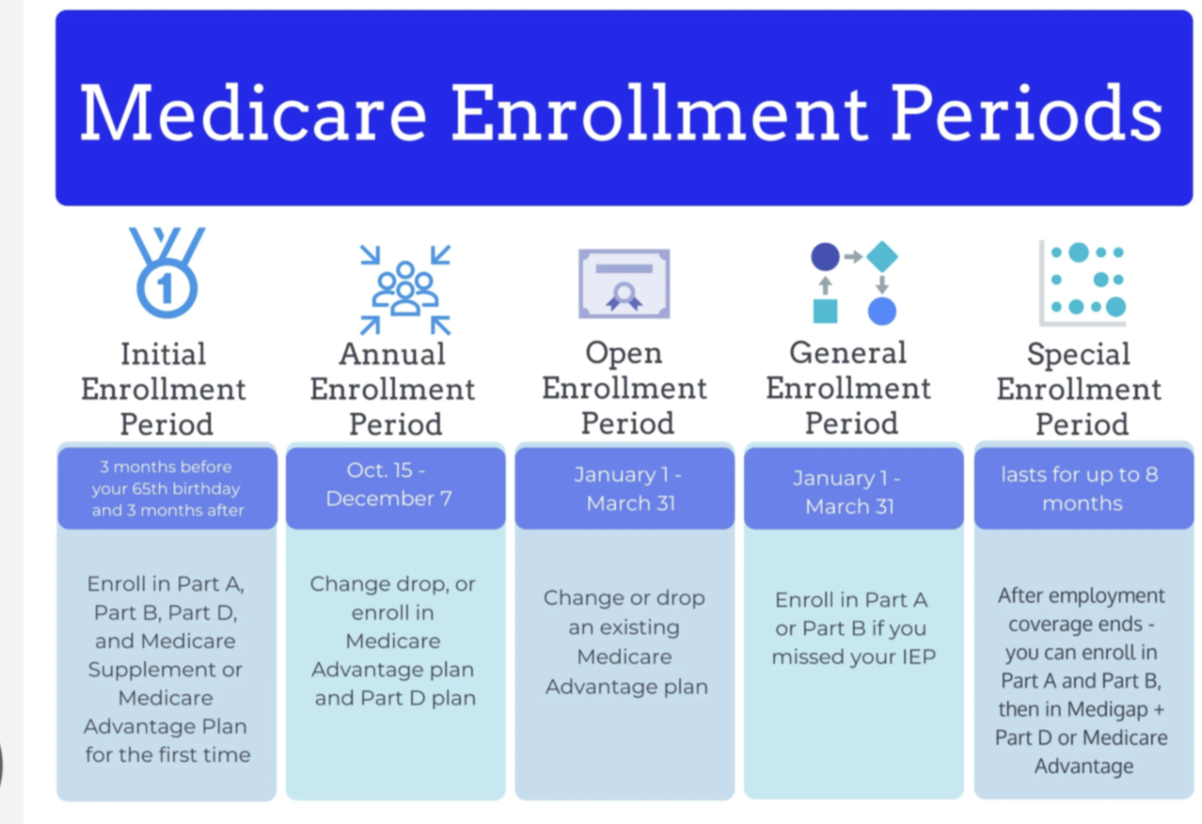

026 Medicare Enrollment Dates: AEP, IEP, & GEP Guide Don't miss a deadline! Learn the key 2026 Medicare enrollment periods, from your 65th birthday to annual open enrollment, and avoid lifetime penalties. Medicare enrollment periods 2026, initial enrollment period, an

Feb 02, 2026

2026 Medicare Cost Guide: Part A, B, & D Premiums Explained,Stay prepared for 2026! Discover the new Medicare Part B premium of $202.90, the Part D $2,100 out-of-pocket cap, and Part A hospital costs.

Jul 15, 2025

Working past 65? Learn how employer size, HSAs, and Medicare enrollment rules affect your health coverage. Get expert guidance from McDonald Group Insurance Services.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.